What is Equilibrium in SMC. Balance and Imbalance in Forex Trading Explained (Smart Money Concepts ICT)

- VasilyTrader

- Sep 23, 2025

- 4 min read

Equilibrium is one of the core elements for understanding market liquidity.

In this article, we will go through the essential basics of liquidity in Forex trading with Smart Money Concepts SMC.

You will learn the interconnections between supply and demand, and I will explain how to easily identify balance and imbalance and what is equilibrium on any market.

Let's start our discussion with understanding how forex pairs move.

What is Buying Imbalance

The price of an asset goes up if the market demand is stronger than the market supply.

The excess of buying activity makes the markets update the highs.

In smart money concepts, such an event will also be called a buying imbalance.

Look at a strong bullish rally on Gold.

The price is going up because of a buying imbalance.

A strong buying activity creates a massive amount of buyers with unfilled orders.

To entice sellers to start selling, they must offer a higher-better price.

What is Selling Imbalance

At the same time, if the price of an asset goes down, it means that the market supply is stronger than a demand.

The excess of supply will make the markets update the lows.

In SMC, it will be called a selling imbalance.

That is exactly what is happening with GBPUSD forex pair.

A strong selling activity and the shortage of demand makes the price go down.

What is Equilibrium in Bear Run

The excess of supply or demand on the market can not be eternal.

The lower the price becomes, the more buyers will start buying, and the more sellers will start closing their positions.

At some moment, the surplus of supply will be absorbed by the buyers.

That will be a moment when the market will find equilibrium, the balance between supply and demand.

A strong bearish imbalance on USDJPY made the price drop significantly.

The falling price made 3 things:

It attracted more buyers, because the lower the price, the more profitable is buying USDJPY.

It discouraged some buyers from buying, considering that the price is already "too low".

It encouraged some buyers to close their positions in profit.

Because of that, USDJPY stopped falling and found a balance in supply and demand. That is what we call Equilibrium.

What is Equilibrium in Bull Run

In a bull run, the higher the price will go, the more sellers will start selling.

At some moment, buying imbalance will be absorbed by the bears and supply & demand will eventually balance.

Such an event will be called the equilibrium.

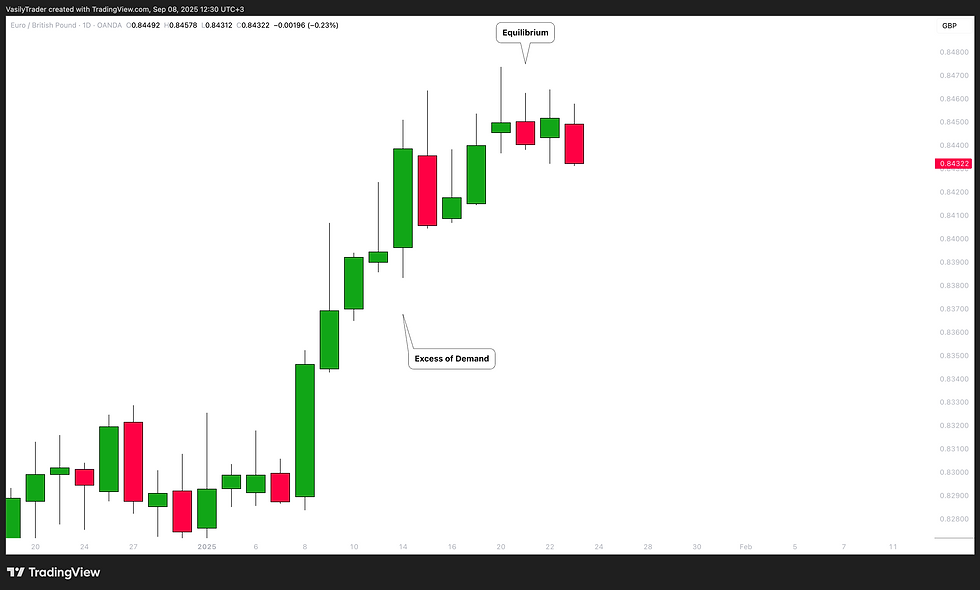

EURGBP was rallying strongly.

The higher the price went, the more sellers started to sell, considering selling the pair more and more profitable.

And the same time, fewer buyers were buying and the more started to close their buy positions in profits.

At some moment, the entire excess of the market demand was absorbed by a supply. The market stopped growing and equilibrium was found.

How to Identify Balance & Equilibrium

One of the main characteristics of a market equilibrium is sideways price movement and a termination of a formation of new highs or new lows.

Usually, such a sideways price action will form a horizontal range.

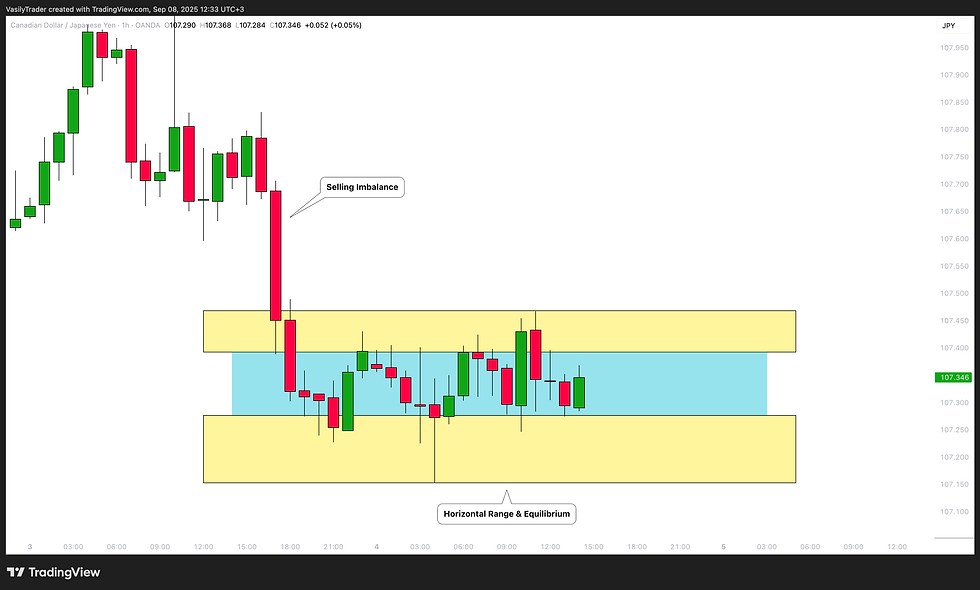

That's a real example how a CADJPY forex pair found an equilibrium after an extended bearish movement. A formation of a horizontal range confirmed a balance between a supply and a demand.

Time Frame Nuance

Please, note that these ranges will form on any time frame that you analyse.

The rule is that the higher is the time frame of the range, the stronger is the market equilibrium.

Above, I have 3 different charts:

USDJPY on a daily time frame,

EURJPY on a 4H,

GBPUSD on 15 minutes.

All the pairs found an equilibrium in horizontal ranges.

An equilibrium on USDJPY will signify intra week or even intra month balance,

On EURJPY it will mean intraday/intra week balance,

On GBPUSD, it will signify intraday equilibrium.

Equilibrium/Balance Termination

Market equilibrium can not last forever.

Fundamentals news and changing market conditions, make the market participants constantly reassess a fair value of an asset.

A violation of the range and a breakout of one of its boundaries will be a trigger of an occurrence of a new imbalance.

A bullish violation of the upper boundary of the range will signify a buying imbalance and a highly probable rise to the new highs.

A bearish violation of the lower boundary of the range will mean a selling imbalance and a highly probable fall to the new lows.

Please, study how GBPCHF was moving for a week on an hourly time frame.

The periods of balance were changed by the periods of bullish or bearish imbalances, that found a new equilibrium on higher/lower price levels.

Essential SMC Trading Basics

Understanding of basic principles of supply and demand is essential for profitable trading Smart Money Concepts SMC.

Learn to recognize the periods of imbalance and equilibrium.

It will provide you the edge in understanding and trading any forex pair.