How to Trade Crude Oil with Smart Money Concepts. Simple USOIL SMC Trading Strategy Explained

- VasilyTrader

- Oct 14, 2025

- 2 min read

Smart Money Concepts is one of the most reliable techniques for trading WTI Crude Oil.

In this article, I will teach you a profitable SMC strategy for analysing and trading USOIL futures and CFD.

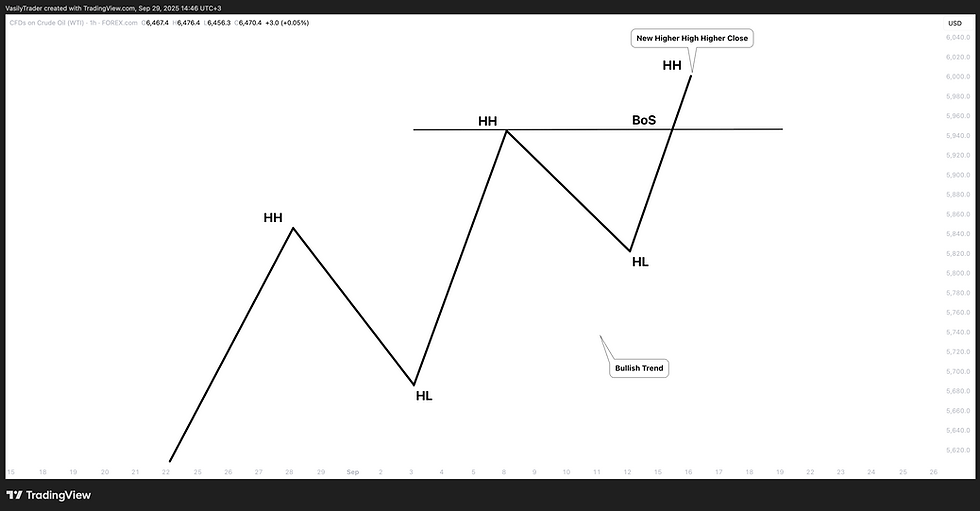

Break of Structure BoS Concept

This simple strategy is based on an important event every SMC trader should know - a Break of Structure BoS.

In a bullish trend, the best Break of Structure will be based on a violation and a candle close above a current higher high.

It will signify a highly probable bullish continuation and provides a great opportunity to buy

Though you can spot a bullish break of structure on any time frame, the most reliable one is a daily.

Correction

After a formation of a new high, I suggest waiting for a short term intraday correctional movement.

With a high probability, the market will retest a recently broken structure and smart money will manipulate the market, pushing the price below that, making buyers close their positions.

Multiple Time Frame Analysis

Once the market starts retracing, analyze an hourly time frame. The price will need to establish an intraday minor bearish trend.

In this bearish trend, 2 trend lines should connect lower highs and lower lows composing an expanding, parallel or contracting channel - a bullish flag pattern.

Best Signal to Buy

Your best signal will be a breakout of a resistance line of the flag and a violation of the level of the last lower high - a bullish change of character after a liquidity grab.

It will confirm a completion of a correction.

Trade Execution

Buy the market on a retest of the level of the last higher low, it will be your best entry.

Set your stop loss at least below a trend line and aim at the next strong daily resistance as TP

That will be a perfect model for trading break of structure on WTI Crude Oil.

Real Example

We spotted such a setup in my trading academy on one of the live streams with my students.

WTI Crude Oil was trading in an uptrend on a daily time frame.

A bullish violation of the last Higher High and a candle close above that confirmed a Break of Structure BoS.

The price started a correctional movement then, and we spotted a bullish flag pattern on an hourly time frame.

The market completed a correction after grabbing a liquidity below a broken structure.

A bullish movement started then, and the price violated a resistance line of the flag and the level of the last lower high.

These 2 breakouts confirmed a completion of a correction and a resumption of a bullish trend.

We opened a buy position immediately on a retest of a broken level of the last lower high.

Stop loss was below a trend line, take profit was based on the closest key daily resistance.

And the price went straight to the target.

Remember This

Break of Structure BoS will be useful for analysis, forecasting and trading WTI Crude Oil.

Combining that with top-down analysis and lower time frames confirmations will provide accurate signals and profitable trading setups.

Integrate a price model that I shared in your strategy, and good luck to you trading USOIL!