Mystic History & Origins Of Smart Money Concepts Trading Strategy (SMC)

- VasilyTrader

- Apr 8, 2024

- 3 min read

Updated: Sep 16, 2024

Smart Money Concepts is one of the most hyped trading strategies and techniques nowadays that attracts newbie traders.

People truly believe that SMC gives birth to a new era of technical analysis and retail trading. They are convinced that this trading strategy beats all classic trading strategies like price action, candlesticks, etc.

In this article, we will discuss the true history and origins of Smart Money Concepts trading, and I will explain to you WHY classic technical analysis is more powerful than you think and WHO invented SMC. REVOLUTION IN TRADING?!

SMC trading is a relatively new strategy in the world of financial markets.

The first mentioning of this strategy start to appear in 2021.

Because the strategy is relatively new, it dramatically lacks the materials, books and trusted sources, to learn that.

At the moment when I noticed the first mentions of SMC, I was trading full-time for 4 years already. SMC quickly attracted my attention, for some unique reason, that we will discuss later on.

In time of Covid, I got a lot of free time, so I decided to sacrifice my time and money for studying this new trading style.

And quite quickly I found myself in trouble:

All the books that I purchased on Amazon about SMC were a complete bullsh*t: they are poorly written and devoid of logic. Most of the SMC courses on YouTube are a complete waste. Premium courses that I purchased were pointless and did not worth any penny.

However, the more I dived into that subject, the more I realized that the classic techniques, strategies, and concepts that I learned in technical analysis are more than enough to start trading SMC strategy.

WHY SMC?

But first, let's discuss what makes Smart Money Concepts so appealing.

SMC trading implies trading with hedge funds, with bankers, with big money. SMC trader knows perfectly well how to recognize MANIPULATIONS. He is not trading against big money but WITH them.

Smart money concepts claim that while the traditional methods of technical analysis are outdated and can not be applied in the modern area of retail trading, SMC brings the revolution.

Not only the idea but also the terminology of SMC is so appealing.

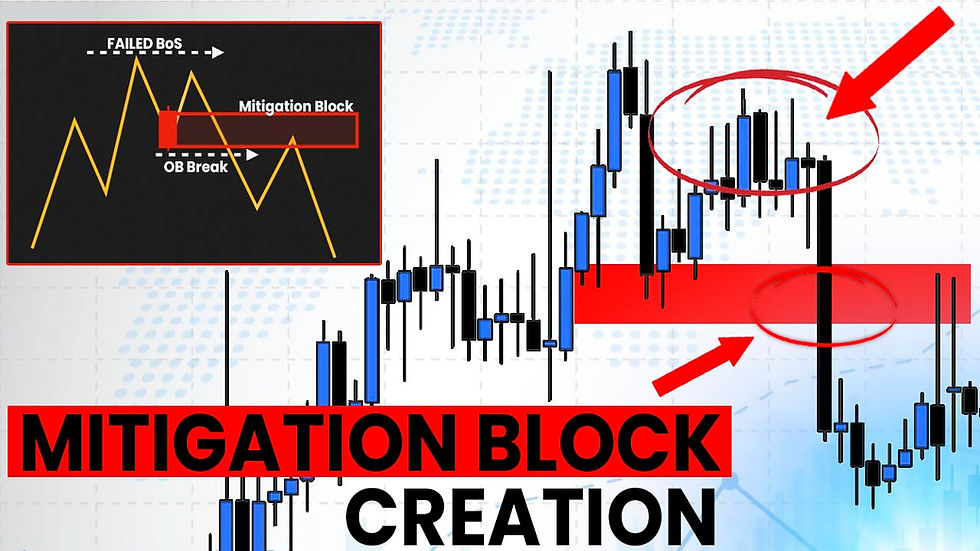

Order blocks, imbalances, liquidity clusters, dark pools, inducement, inefficiencies, fair value gaps.

These words are so fancy and attention grabbing, that classic terminology like support and resistance fades into the background.

The charts of Smart Money traders are also unique:

The color palette is blue color-based, it looks different and very fancy.

Of course, when newbie traders start trading, they immediately become attracted by the vividness of SMC. BEST TRADING STRATEGY EVER?

But is there something behind that brilliance?

The truth is that SMC simply takes the classic technical analysis concepts and names and explains that in different words.

Liquidity pools/clusters replace support and resistance.

Imbalance replaces bullish/bearish engulfing candles.

Inducement is a fancy new name of false breakout / fake out.

Order block substitute retest.

Fair value gap - oversold / overbought condition.

Change of Character - trend violation and reversal.

The only thing that remains untouched is a basic structure mapping, with Higher High HH, Higher Lows HL, Lower Highs LH, Lower Lows LL.

Looks like the creators of SMC run out of imagination at that stage.

But does SMC provide a new way to trade a price action?

Unfortunately not.

There is an old, already forgotten trading strategy that is called "False Breakout Strategy".

The idea of this strategy is to wait for a false violation of an important key level, look for a confirmation that the breakout is false and a trap, and open a trading position in the opposite direction.

Let's compare false breakout strategy and SMC strategy:

On the right, you can see a classic false breakout strategy.

On the left, you can see the SMC interpretation of false breakout trading.

Obviously, both strategies do absolutely the same, naming and explaining save things and events in different ways.

SCAM ALERT?!

Does it mean that Smart Money Concepts are a scam?

Well, not really. As I already described, the core of SMC strategy is classic technical analysis: key levels, price action, candlesticks. It is a new, fancy interpretation of old-fashioned false breakout strategy, the strategy that proved to be profitable and efficient.

Certainly the strategy works, and the more I studied that, the more I realized that I already know all that. Studying the SMC the main thing that I learned was a new way of explanation of old things.

The inventor of SMC trading is genius.

He managed to create a new flow in retail trading by inventing nothing new. He simply found a way to sell an old, already forgotten strategy in a new package.

It does not mean that you should not trade SMC, but do not overestimate its significance because its origins clearly shows that itis entirely based on the principles of technical analysis.